Choosing accounting software shouldn't feel like gambling with your business's financial future. Yet many Indian businesses face exactly this dilemma: stick with traditional accounting software they know, or switch to AI-powered platforms promising automation and efficiency.

The decision matters more than ever in 2026. With GST compliance growing stricter, transaction volumes increasing, and business competition intensifying, your accounting system can either accelerate growth or become a bottleneck.

This comprehensive guide compares AI accounting software with traditional accounting systems specifically for Indian businesses—covering how each works, what makes them different, real-world performance comparisons, and which one your business should choose.

How Traditional Accounting Software Works

Traditional accounting software—platforms like Tally, Busy, and basic versions of QuickBooks—has been the backbone of Indian business accounting for decades.

The Core Mechanism

Traditional software follows a rules-based, manual input model:

Manual Data Entry: Someone types invoice details, amounts, dates, and party information into the system

Rule Application: Software applies predefined rules (like tax rates or ledger mappings) that you've configured

Calculation: Built-in formulas calculate totals, taxes, and balances

Storage: Data is stored locally on your computer or basic cloud storage

Reporting: Generate reports by querying stored data

What Traditional Software Does Well

Established and Familiar: Accountants and business owners have used tools like Tally for years. The interface, shortcuts, and workflows are well-known, reducing training time.

Complete Control: You decide exactly how to categorize every transaction, map every ledger, and structure every report. Nothing happens automatically unless you explicitly program it.

Offline Capability: Desktop-based traditional software works without constant internet connectivity—important in areas with unreliable connections.

One-Time Purchase Options: Some traditional software offers perpetual licenses with one-time payments rather than annual subscriptions.

The Limitations That Matter

Time-Intensive: Every invoice, bill, and transaction requires manual typing. For businesses processing hundreds of monthly transactions, this consumes 2-4 hours daily.

Error-Prone: Manual data entry has an average error rate of 10-15%. These mistakes multiply across GST filings, financial reports, and compliance documents.

Static Rules: Traditional software doesn't learn. If you've set up ledger mapping rules, they remain exactly the same until you manually change them—regardless of whether better patterns exist.

Delayed Insights: Financial reports reflect what you've entered. If data entry is behind by a week, your reports are outdated by a week—making real-time decision-making impossible.

Reconciliation Burden: Matching bank statements with accounting entries, verifying GST data with portal information, and cross-checking invoices requires extensive manual effort.

Limited Scalability: As your business grows, the accounting workload increases proportionally. More transactions mean more hours spent on data entry, not better systems handling the growth.

Real-World Traditional Accounting Scenario

Typical Monthly Workflow:

Week 1: Enter previous month's purchase invoices manually (8-10 hours)

Week 2: Create and record sales invoices (6-8 hours)

Week 3: Reconcile bank statements line by line (4-6 hours)

Week 4: Prepare GST returns by compiling data (3-5 hours)

Total Time: 21-29 hours per month on routine bookkeeping

This leaves little time for analysis, tax planning, or strategic financial decisions.

What Makes AI Accounting Different

AI accounting software fundamentally reimagines how financial data is captured, processed, and analyzed.

The AI-Powered Mechanism

Instead of manual entry and static rules, AI accounting uses intelligent automation and machine learning:

Automated Data Capture: Upload documents (invoices, receipts, statements) and AI extracts all relevant data using OCR (Optical Character Recognition)

Pattern Learning: Machine learning algorithms learn your business patterns—which suppliers go to which ledgers, typical transaction amounts, recurring entries

Smart Validation: AI flags anomalies, duplicates, and errors before posting

Continuous Improvement: The system gets smarter with every transaction, improving accuracy over time

Real-Time Processing: Data is processed and available immediately for reporting and decision-making

The Key Differentiators

1. Intelligent Data Extraction

Traditional: You manually type "ABC Suppliers, Invoice #1234, ₹10,000 + ₹1,800 GST"

AI: You upload the invoice PDF or photo. AI reads it and extracts: Vendor name, GSTIN, invoice number, date, line items with HSN codes, quantities, rates, and GST—creating the complete entry automatically.

Impact: What took 3-5 minutes per invoice now takes 10-15 seconds.

2. Self-Learning Systems

Traditional: You set up ledger "Electricity Expense" once. Every electricity bill forever requires you to select this ledger manually.

AI: After seeing 2-3 electricity bills from the same supplier, AI automatically maps future bills to the correct ledger. It learns your classification patterns.

Impact: Manual selection decreases from 100% of transactions to less than 5% over time.

3. Proactive Error Detection

Traditional: Errors are discovered during audits, GST filing, or reconciliation—often weeks after they occurred.

AI: System flags potential issues instantly:

"This invoice number was already entered"

"Amount seems unusual for this supplier"

"GST number doesn't match GSTIN format"

"Invoice date is future-dated"

Impact: Errors caught and corrected immediately rather than creating cascading problems.

4. Predictive Intelligence

Traditional: Reports show what happened (historical data).

AI: System predicts what will happen:

"Based on payment patterns, ₹3.2 lakh will be received in next 15 days"

"Current expense run-rate suggests ₹45,000 shortfall by month-end"

"This customer typically pays 5 days late—adjust cashflow forecasts"

Impact: Shift from reactive ("what went wrong?") to proactive ("what should we do?") financial management.

5. Continuous Reconciliation

Traditional: Month-end reconciliation takes 4-6 hours as you manually match hundreds of transactions.

AI: System reconciles automatically and continuously. Bank transactions, invoices, and payments are matched in real-time. By month-end, reconciliation is already complete.

Impact: Month-end closes in minutes instead of hours or days.

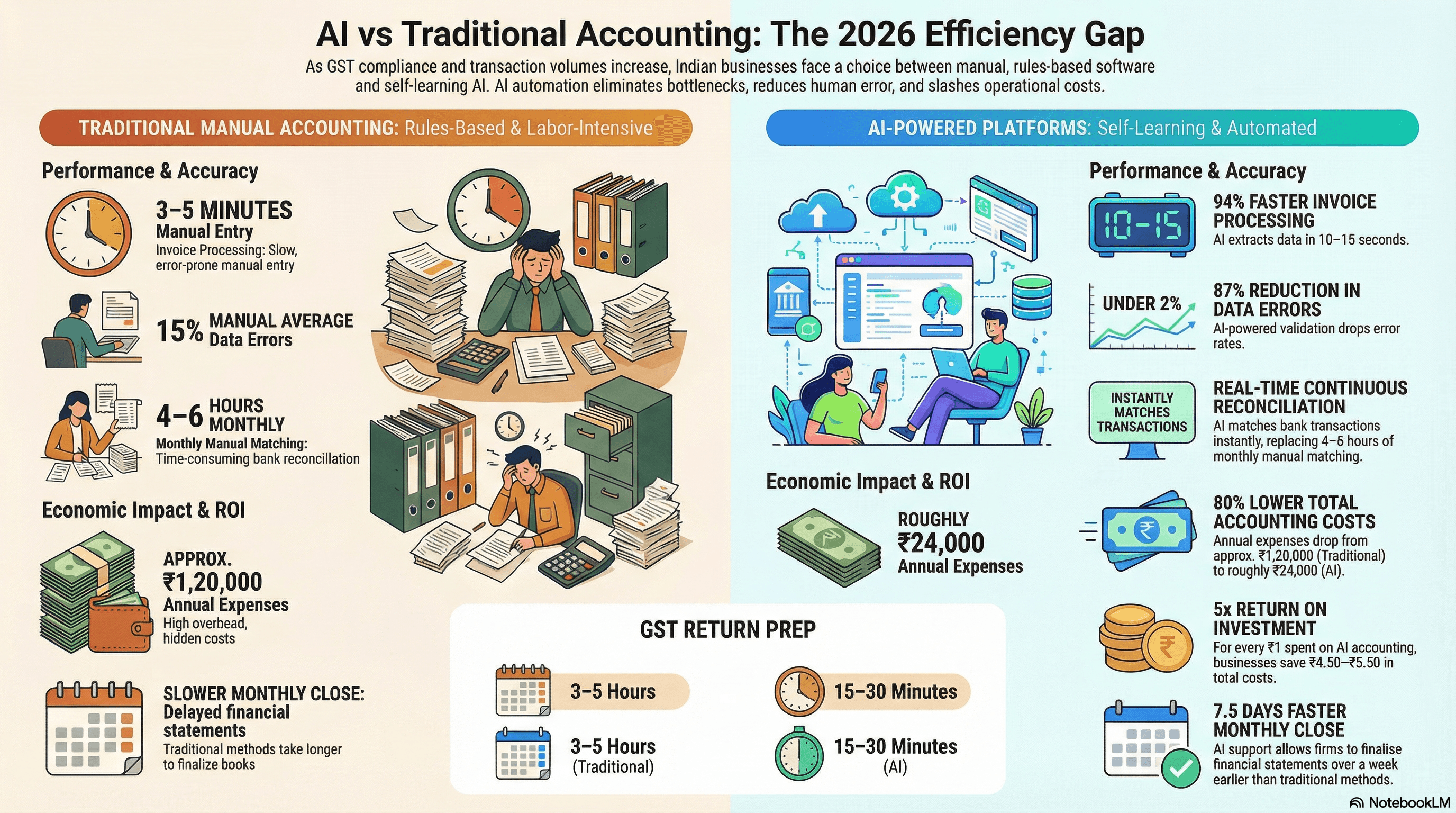

Time, Accuracy & Cost Comparison

Let's quantify the differences with real-world metrics from studies and user data.

Time Savings

Task | Traditional | AI Accounting | Time Saved |

Invoice Data Entry | 3-5 min per invoice | 10-15 sec per invoice | 94% faster |

Bank Reconciliation | 4-6 hours monthly | 15-30 min monthly | 90% faster |

GST Return Prep | 3-5 hours | 15-30 min (one-click) | 85% faster |

Expense Categorization | 2-3 min per entry | Automatic | 100% time saved |

Monthly Close | 2-3 days | Same day | 66-75% faster |

Overall Monthly Bookkeeping | 25-30 hours | 3-5 hours | 80-85% reduction |

Stanford Research Findings: Accountants using AI support more clients per week and finalize monthly statements 7.5 days faster than those using traditional methods. They spend 8.5% less time on routine back-office processing.

Accuracy Improvements

Error Type | Traditional | AI Accounting | Improvement |

Data Entry Errors | 10-15% | <2% | 87% reduction |

Duplicate Entries | 3-5% | <0.5% | 90% reduction |

Incorrect Ledger Mapping | 8-12% | 2-3% | 75% reduction |

GST Calculation Mistakes | 5-7% | <1% | 85% reduction |

Reconciliation Discrepancies | 15-20% | 2-4% | 85% reduction |

Stanford Study: Firms using AI saw a 12% rise in reporting granularity, meaning they kept more detailed records with fewer errors.

Cost Analysis

For a Small Business (100-200 transactions/month):

Traditional Software Costs:

Software license: ₹10,000-15,000/year

Data entry time (20 hrs/month × ₹300/hr): ₹72,000/year

CA fees for GST filing: ₹24,000/year

Error correction and penalties: ₹10,000-20,000/year

Total: ₹1,16,000-1,31,000/year

AI Accounting Costs:

Software subscription (hisabkitab Boost Plan): ₹4,999/year

Review time (3 hrs/month × ₹300/hr): ₹10,800/year

Minimal CA involvement: ₹6,000/year

Near-zero error costs: ₹2,000/year

Total: ₹23,799/year

Net Annual Savings: ₹92,000-1,07,000 (79-82% cost reduction)

ROI: Every ₹1 spent on AI accounting saves ₹4.5-5.5 in total costs.

Real-World Examples: Indian Business Scenarios

Scenario 1: Retail Store Owner (Traditional to AI)

Business: Grocery store in Pune, 300 monthly transactions

Traditional Experience:

Owner spent 2-3 hours daily entering bills and sales

Made frequent errors in GST calculations

Month-end GST filing was stressful and often late

Couldn't track real-time profitability or cash position

Lost input credit worth ₹15,000 annually due to reconciliation errors

After Switching to AI (hisabkitab):

Upload supplier invoices via mobile; data extracted automatically

Sales automatically recorded through POS integration

GST returns generated with one click, always on time

Real-time dashboard shows current profit and cash position

Zero lost input credit due to automated GSTR-2B reconciliation

Time saved: 50 hours/month, Money saved: ₹45,000/year

Scenario 2: IT Services Startup (AI from Day 1)

Business: Software development agency in Bangalore, 50 clients

Why They Chose AI:

Young team comfortable with cloud technology

Needed scalability as client base grew rapidly

Required project-wise profitability tracking

Couldn't afford dedicated accounting staff initially

Results with hisabkitab:

Founder manages all accounting in 30 minutes daily

Project-wise expense tracking shows exactly which clients are profitable

Automated invoicing with WhatsApp delivery improved payment collection by 40%

Scaled from 10 to 50 clients without adding accounting staff

Time investment: 3 hours/month vs 25+ hours with traditional software

Scenario 3: Manufacturing SME (Hybrid Approach)

Business: Small auto-parts manufacturer in Chennai, complex requirements

Challenge: Needed both depth of traditional systems and speed of AI

Solution: AI for routine tasks, traditional oversight for complex transactions

AI handles supplier invoice entry, bank reconciliation, routine GST tasks

Human accountant focuses on costing, inventory valuation, financial analysis

CA reviews reports but doesn't do data entry

Results:

Accounting staff reduced from 3 to 1 person

Error rate dropped from 12% to less than 3%

Monthly close accelerated from 5 days to 1 day

Staff salary savings: ₹4.8 lakhs/year

Software cost: ₹6,999/year

Net benefit: ₹4.7 lakhs/year

Which One Should Indian Businesses Choose?

The right choice depends on your specific situation. Here's a decision framework.

Choose Traditional Accounting Software If:

✅ Your transaction volume is very low (under 50/month) and manual entry isn't a burden

✅ You have unreliable or no internet connectivity and need offline-first software

✅ Your team is highly resistant to change and you lack the resources to manage transition

✅ You have extremely complex, unique accounting needs that off-the-shelf AI can't handle yet

✅ You're a CA firm managing legacy clients who require traditional software compatibility

Choose AI Accounting Software If:

✅ You process 100+ transactions monthly and manual entry consumes significant time

✅ You want to scale your business without proportionally increasing accounting staff

✅ GST compliance is stressful and you've faced penalties or lost input credit

✅ You need real-time financial visibility for decision-making, not month-old reports

✅ Accuracy matters more than feeling of control over every manual entry

✅ Your team uses smartphones comfortably and can adapt to modern software

✅ You're a growing startup or SME looking to operate efficiently from day one

The Hybrid Approach (Best for Many Businesses)

You don't have to choose completely. Many successful businesses use:

AI for Routine Tasks:

Invoice data entry

Bank reconciliation

Expense categorization

GST return preparation

Payment reminders

Human Review for Complex Items:

Inventory valuation

Asset depreciation

Loan accounting

Capital transactions

Final report review

This combines AI's speed and accuracy on repetitive tasks with human judgment on complex matters.

Common Concerns About Switching to AI

"Will AI Replace My Accountant?"

No. AI replaces repetitive tasks, not accountants. Research from Stanford shows accountants using AI spend their time on:

Business communication and advisory (increased)

Quality assurance and review (increased)

Strategic planning and tax optimization (increased)

Manual data entry (drastically decreased)

Your accountant becomes more valuable—focusing on strategy instead of data entry.

"Is My Data Safe with AI and Cloud?"

Yes, when you choose the right platform. hisabkitab uses:

Bank-level 256-bit encryption

Automatic daily backups at multiple locations

Role-based access controls

Multi-factor authentication

Compliance with Indian data regulations

Your data is safer on professionally managed cloud infrastructure than on a local computer vulnerable to theft, fire, or hardware failure.

"What If the AI Makes Mistakes?"

AI systems include human review checkpoints. hisabkitab's workflow:

AI extracts data from documents

System presents data for review

You approve or correct before posting

AI learns from your corrections

You maintain control while benefiting from automation. Over time, as AI learns your patterns, the review time decreases but the oversight remains.

"Is It Too Expensive for Small Businesses?"

No. Cost comparison shows AI accounting is significantly cheaper than traditional approaches when you account for:

Time saved (the hidden cost of manual work)

Errors prevented (penalties and lost credit)

Growth without hiring (scalability)

With hisabkitab's plans starting at ₹2,999/year, even small businesses save money compared to the true cost of traditional systems.

"Will It Work with My Existing Data?"

Yes. hisabkitab offers one-click migration from:

Tally (all versions)

Busy

Excel spreadsheets

Other accounting systems

All historical data—customers, suppliers, inventory, transactions, and balances—transfers securely with full validation.

The Bottom Line: What Research and Reality Show

The evidence is overwhelming: AI accounting software delivers measurable, significant benefits for Indian businesses.

Time Savings: 80-85% reduction in bookkeeping time

Accuracy Improvement: 85-90% fewer errors

Cost Savings: 75-80% lower total accounting costs

Faster Closes: 7.5 days faster monthly closes

Better Decisions: Real-time data enables proactive management

Easier Scaling: Handle 3x growth without proportional cost increase

The shift isn't about replacing human expertise—it's about amplifying it. AI handles the routine, repetitive 80% of accounting tasks, freeing humans to focus on the strategic 20% that drives business value.

For Indian businesses specifically, AI accounting solves critical pain points:

GST Complexity: Automated compliance with e-invoicing, GSTR generation, and reconciliation

Limited Resources: Small teams can handle large workloads

Growth Ambitions: Scale without hiring constraints

Competitive Pressure: Operate at enterprise efficiency with SME budgets

Traditional accounting software served India well for decades. But in 2026, continuing with manual, time-intensive methods means falling behind competitors who are leveraging AI for speed, accuracy, and strategic insight.

Making the Switch: How to Transition Smoothly

If you're convinced AI accounting is right for your business, here's how to transition without disruption.

Step 1: Choose the Right Platform (Week 1)

Evaluate options based on:

India-specific features (GST, e-invoicing, Indian banks)

Ease of use for your team's skill level

Integration with tools you already use

Pricing that fits your budget

Quality of support and training

hisabkitab stands out for:

Built by CAs specifically for Indian businesses

Native GST compliance with e-invoicing

AI OCR that handles poor quality documents

WhatsApp integration (how Indians actually communicate)

Affordable plans from ₹2,999/year

Free trial to test risk-free

Step 2: Migrate Your Data (Week 2)

Use one-click migration from Tally/Busy/Excel

Verify all masters (customers, suppliers, inventory) transferred correctly

Confirm opening balances match exactly

Test with a few sample transactions before going live

Step 3: Train Your Team (Week 2-3)

Focus on the workflows they'll use daily (upload invoices, review entries, approve)

Start with 2-3 practice sessions of 1-2 hours each

Create simple cheat sheets for common tasks

Designate one "super user" who gets extra training

Step 4: Run Parallel for Confidence (Week 3-4)

Process transactions in both old and new systems

Compare reports daily to build confidence

Identify and fix any workflow gaps

Use this period for team to get comfortable

Step 5: Go Live Fully (Week 4+)

Make the new system primary

Keep old system accessible for reference temporarily

Monitor closely for first month

Gather feedback and optimize workflows

Timeline: Most businesses complete full transition in 4-6 weeks with zero operational disruption.

Experience AI Accounting with hisabkitab

hisabkitab makes AI accounting accessible, affordable, and effective for every Indian business—from kirana stores to growing enterprises.

Why hisabkitab Is the Right Choice

Built for India: Native GST compliance, e-invoicing, e-way bills, GSTR generation, Indian bank integrations (140+), and WhatsApp invoice sharing.

AI That Works: Upload any invoice/receipt format—PDF, image, WhatsApp screenshot—and AI extracts all data automatically. Learning engine gets smarter with your usage.

Complete Automation: Bank reconciliation, ledger mapping, tax calculations, duplicate detection, and compliance checks—all automatic.

Real-Time Intelligence: Dashboards showing current financial position, cashflow forecasts, party-wise tracking, and profitability analysis—updated live.

Easy Migration: One-click transfer from Tally, Busy, Excel with full data validation and zero business disruption.

Transparent Pricing:

Free Plan: Test unlimited invoicing

Launch (₹2,999/year): Perfect for small businesses

Boost (₹4,999/year): Growing SMEs with advanced needs

Advance (₹6,999/year): Established businesses needing full AI power

Expert Support: Built by CAs, supported by CAs—get accounting expertise, not just technical help.

Get Started Today

✓ Free Trial: Full features, zero cost, no credit card required

✓ 5-Minute Setup: Operational within minutes

✓ One-Click Migration: Transfer from Tally/Busy/Excel instantly

✓ Expert Guidance: CAs help with setup and optimization

✓ Money-Back Confidence: Try risk-free

Visit hisabkitab.co now and experience the difference AI accounting makes.

About hisabkitab: India's AI-powered cloud accounting platform trusted by 10,000+ businesses. Built by Chartered Accountants for Indian SMEs, startups, and freelancers, hisabkitab automates GST compliance, eliminates manual data entry, and delivers real-time financial intelligence—at prices every business can afford.

Continue Reading