Why Startups in Bhutan Need Smart Accounting Software

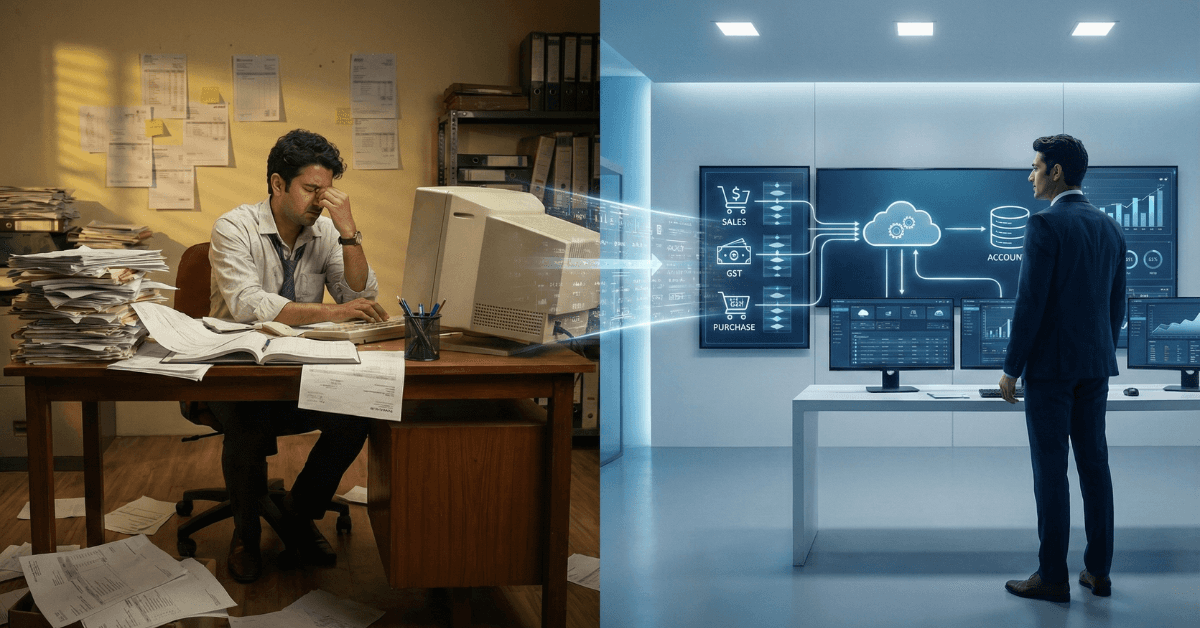

Starting a business in Bhutan is exciting but managing finances from day one is equally important. Many startups begin with Excel sheets, manual bills, or basic bookkeeping methods. While this may work initially, as the business grows, managing expenses, invoices, and TPN records becomes difficult.

Startups must track income, expenses, investor funds, and vendor payments accurately. Without proper accounting software, founders often struggle with unclear financial reports, missing entries, and compliance issues.

Modern cloud accounting software helps Bhutan startups maintain organised records, automate bookkeeping, and stay ready with structured financial reports. Businesses in Bhutan are increasingly adopting digital accounting tools to maintain clean and audit-ready records.

This blog explores the top 10 accounting software for startups in Bhutan that help manage finances efficiently and support business growth.

What Startups in Bhutan Should Look for in Accounting Software

Before selecting accounting software, startups should ensure it offers:

TPN-ready invoicing and records

Invoices and transactions should be linked to proper TPN details to maintain structured records.

Expense and income tracking

Track operational costs, revenue, and profitability clearly.

Real-time financial reports

Access profit & loss, cash flow, and expense summaries anytime.

Cloud-based access

Founders and accountants should be able to access data from anywhere.

Automation features

Automatic entry from bills and expenses reduces manual work.

Scalability

The software should support growth as the startup expands.

Top 10 Accounting Software for Startups in Bhutan

1. hisabkitab

hisabkitab is a modern cloud accounting software designed for startups, SMEs, and growing businesses. It helps startups manage billing, expenses, and bookkeeping in one place.

Key features:

TPN-ready invoicing and records

AI-powered expense and invoice entry

Real-time profit and expense tracking

Customer and vendor outstanding tracking

Cloud-based access

Simple dashboard for founders

Startups in Bhutan benefit from structured and organised accounting, especially when managing TPN-linked transactions and financial reporting.

Best for: Startups looking for simple cloud accounting with automation.

2. Zoho Books

Zoho Books is a popular cloud accounting software used by startups globally and accessible in Bhutan.

Key features:

Professional invoicing

Expense tracking

Bank reconciliation

Financial reports

Multi-currency support

Zoho Books helps startups manage end-to-end accounting from invoicing to reporting.

Best for: Tech startups and service businesses.

3. QuickBooks Online

QuickBooks Online is widely used by small and medium businesses for bookkeeping and reporting.

Key features:

Automated bookkeeping

Expense and income tracking

Real-time dashboards

Custom financial reports

It is accessible to Bhutan businesses and helps track financial performance efficiently.

Best for: Growing startups with accountants.

4. TallyPrime

TallyPrime is a trusted accounting software used by many businesses in Bhutan for financial management and inventory tracking.

Key features:

Accounting and bookkeeping

Inventory tracking

Financial reporting

Payroll and taxation support

It is widely used by businesses in cities like Thimphu and Phuentsholing.

Best for: Startups with traditional accounting setup.

5. Busy Accounting Software

Busy offers accounting and inventory features suitable for startups dealing with products.

Key features:

Billing and accounting

Inventory management

Financial reports

Expense tracking

It is trusted by many SMEs for managing accounts and reporting.

Best for: Trading and distribution startups.

6. Xero

Xero is a cloud-based accounting platform designed for startups and growing businesses.

Key features:

Real-time bank reconciliation

Financial dashboards

Multi-user collaboration

Expense tracking

Best for: Startups working with remote accountants.

7. ERPNext

ERPNext combines accounting, CRM, and inventory into one system.

Key features:

Accounting and billing

Inventory management

Project tracking

Financial reports

Best for: Startups planning long-term scaling.

8. Vyapar

Vyapar offers simple billing and accounting tools for small businesses and startups.

Key features:

Easy invoicing

Expense tracking

Customer outstanding tracking

Mobile and desktop access

Best for: Small local startups.

9. myBillBook

myBillBook focuses on billing and basic accounting for small businesses.

Key features:

Invoice creation

Expense tracking

Payment tracking

Simple interface

Best for: Early-stage startups.

10. Sage Business Cloud

Sage provides cloud accounting and bookkeeping tools for startups.

Key features:

Financial reporting

Expense tracking

Invoicing

Cloud-based access

Best for: Startups wanting simple bookkeeping tools.

How to Choose the Right Accounting Software for Your Startup

When selecting accounting software, consider:

Ease of use for founders

TPN-ready accounting support

Real-time financial visibility

Automation features

Cloud access

Scalability as business grows

Choosing the right software early helps startups maintain accurate records and avoid future accounting complications.

Conclusion

Startups in Bhutan are increasingly adopting cloud accounting software to manage finances efficiently and maintain structured records. Digital accounting tools help automate bookkeeping, improve accuracy, and provide real-time insights into business performance.

Using reliable accounting software allows startups to focus on growth while keeping financial data organised, compliant, and easy to manage.

Continue Reading