Introduction: Why Cost Accounting Matters More Than Ever

In today’s competitive business world—where margins are thin, customers demand better pricing, and efficiency decides survival—cost accounting is no longer optional.

It is the backbone of decision-making for manufacturing units, traders, agencies, startups, and service companies.

Yet many Indian businesses still struggle with:

scattered cost data

manual calculations

untracked expenses

guess-based pricing

no visibility into profit per product/project

This is exactly where cost accounting and modern cloud tools like hisabkitab make a massive difference.

What Is Cost Accounting?

Cost accounting is a system of recording, analyzing, and controlling all costs related to production, operations, and services.

Its goal is simple: help businesses understand the true cost of what they produce or sell.

Compared to normal accounting (which focuses on compliance), cost accounting focuses on decision-making.

Why Do Businesses Use Cost Accounting?

Cost accounting helps you:

✔️ Identify your real cost per product or project

✔️ Set the right selling price

✔️ Avoid losses by spotting excessive expenses

✔️ Improve efficiency of employees, machines & processes

✔️ Decide what to scale—and what to discontinue

✔️ Estimate profitability before entering new markets

It gives founders and finance teams the actual picture behind profits, not just the financial statements.

Types of Costs in Cost Accounting

To understand cost accounting properly, you must know the cost components:

1. Direct Costs

Costs directly related to production:

Raw materials

Direct labour

Consumables

2. Indirect Costs

These are overheads that support the business:

Rent

Utilities

Salaries

Depreciation

3. Fixed Costs

Do not change with output:

Factory rent

Equipment lease

4. Variable Costs

Increase as production increases:

Materials

Packaging

Delivery charges

5. Semi-Variable Costs

Fixed + variable combined:

Electricity

Maintenance

Cost accounting groups these to calculate accurate costing.

Methods of Cost Accounting

Different industries use different methods:

1. Standard Costing

Predetermined costs used to measure performance.

2. Marginal Costing

Cost is calculated per additional unit produced.

3. Activity-Based Costing (ABC)

Costs are allocated based on activities like processing, packing, shipping, etc.

4. Job Costing

Used in projects, construction, agencies, and CAs.

5. Process Costing

Used by manufacturers—textile, chemicals, FMCG, etc.

6. Batch Costing

Used for bakeries, pharma, food production, packaging.

How Cost Accounting Helps in Pricing

One of the biggest benefits:

You know exactly how much it costs to make or deliver something.

So you can set selling prices confidently and avoid losses.

Example:

If your real product cost is ₹220 but you're selling for ₹200, cost accounting exposes it immediately.

Common Problems Indian Businesses Face Without Cost Accounting

❌ Wrong pricing

❌ Confusion in profit per product

❌ High wastage / leakage

❌ Stock mismatch

❌ Overspending on labour or materials

❌ No clarity on which product/service is profitable

Cost accounting fixes every one of these.

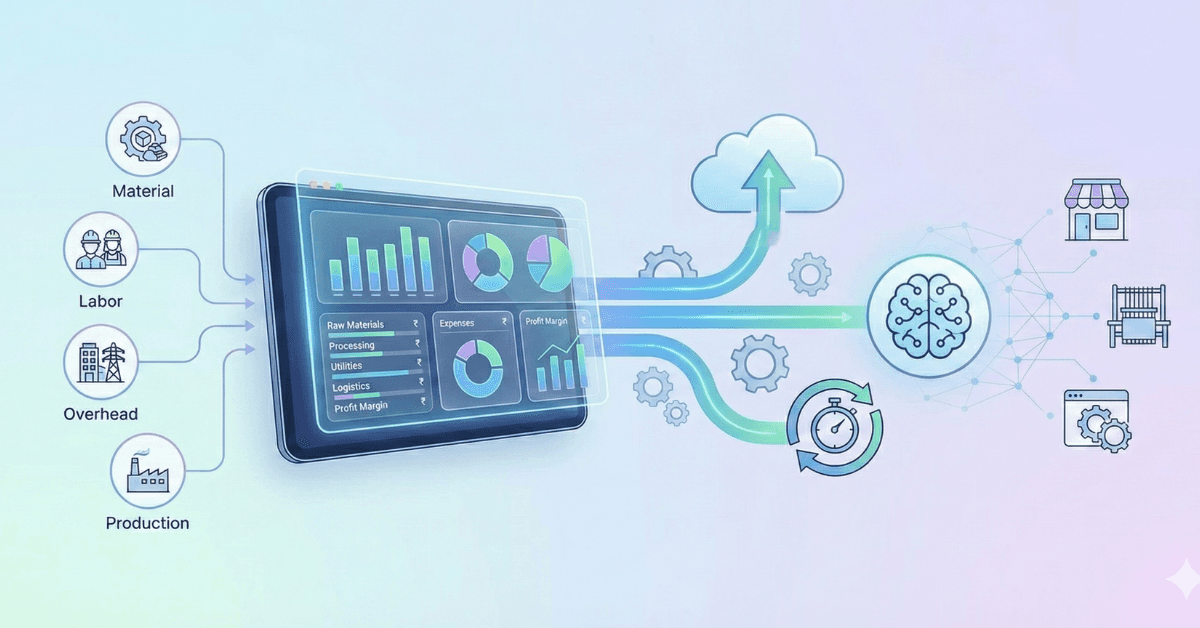

Where hisabkitab Comes In: Cost Accounting Made Simple

Traditional cost accounting is:

manual

time-consuming

spreadsheet heavy

prone to errors

hisabkitab brings automation, AI, and cloud convenience to the entire system.

How hisabkitab Helps With Cost Accounting

1. Automatic Expense Categorization

hisabkitab automatically groups expenses into:

direct

indirect

fixed

variable

overheads

No manual classification needed.

2. Item-Level Cost Tracking

For manufacturing & trading:

raw material cost

purchase price fluctuations

landed cost

production cost

packaging cost

All calculated automatically.

3. Project / Job Costing

Perfect for:

agencies

CAs & professionals

service companies

construction firms

Track:

labour

tools

overhead

time spent

vendor bills

→ See profit per project instantly.

4. AI-Based Cost Insights

hisabkitab’s AI engine helps:

predict rising cost areas

suggest ideal pricing

highlight loss-making items

track month-on-month cost trends

5. Inventory + Cost Integration

Real-time costing based on:

purchase rates

BOM

stock movement

wastage

production cycles

6. Cost Reports in One Click

hisabkitab generates:

Cost sheets

Margin analysis

Break-even report

Profit per product

Expense trend report

Job costing summary

Perfect for decision-making & investor reporting.

Who Should Use Cost Accounting?

Cost accounting is essential for:

✔️ Manufacturers

✔️ Traders & wholesalers

✔️ Startups

✔️ Restaurants & cloud kitchens

✔️ Agencies & professionals

✔️ Service businesses

✔️ CAs managing multiple clients

If you're in business, cost accounting isn’t optional anymore.

Benefits of Using hisabkitab for Cost Accounting

✔ Increased Profitability

Find leakages, optimise spending.

✔ Better Pricing Decisions

Sell confidently with correct costs.

✔ Stress-Free Tax Compliance

Automatically maps GST, TDS, expenses, ledgers.

✔ AI-Based Financial Insights

Know what to change before problems happen.

✔ No More Excel Chaos

Cloud + automation = zero errors.

Conclusion: Cost Accounting Is Your Profit Engine

Businesses that implement cost accounting grow 30–50% faster and reduce unnecessary expenses significantly.

With automated tools like hisabkitab, even small businesses and early-stage startups can manage cost accounting professionally—without hiring a full finance team.

👉 Cost accounting tells you the truth behind your business numbers.

hisabkitab automates that truth.

Continue Reading